What is the issue?

Download WhitepaperFinancial businesses have already gone far beyond traditional services providing their clients with access to their personal accounts via online channels and mobile devices. Digital transformation brings new opportunities, clients and of course, more revenue. On the other hand, it opens the doors to fraudsters with new sophisticated schemes, cross-channel attacks both on the user’s device and on the account.

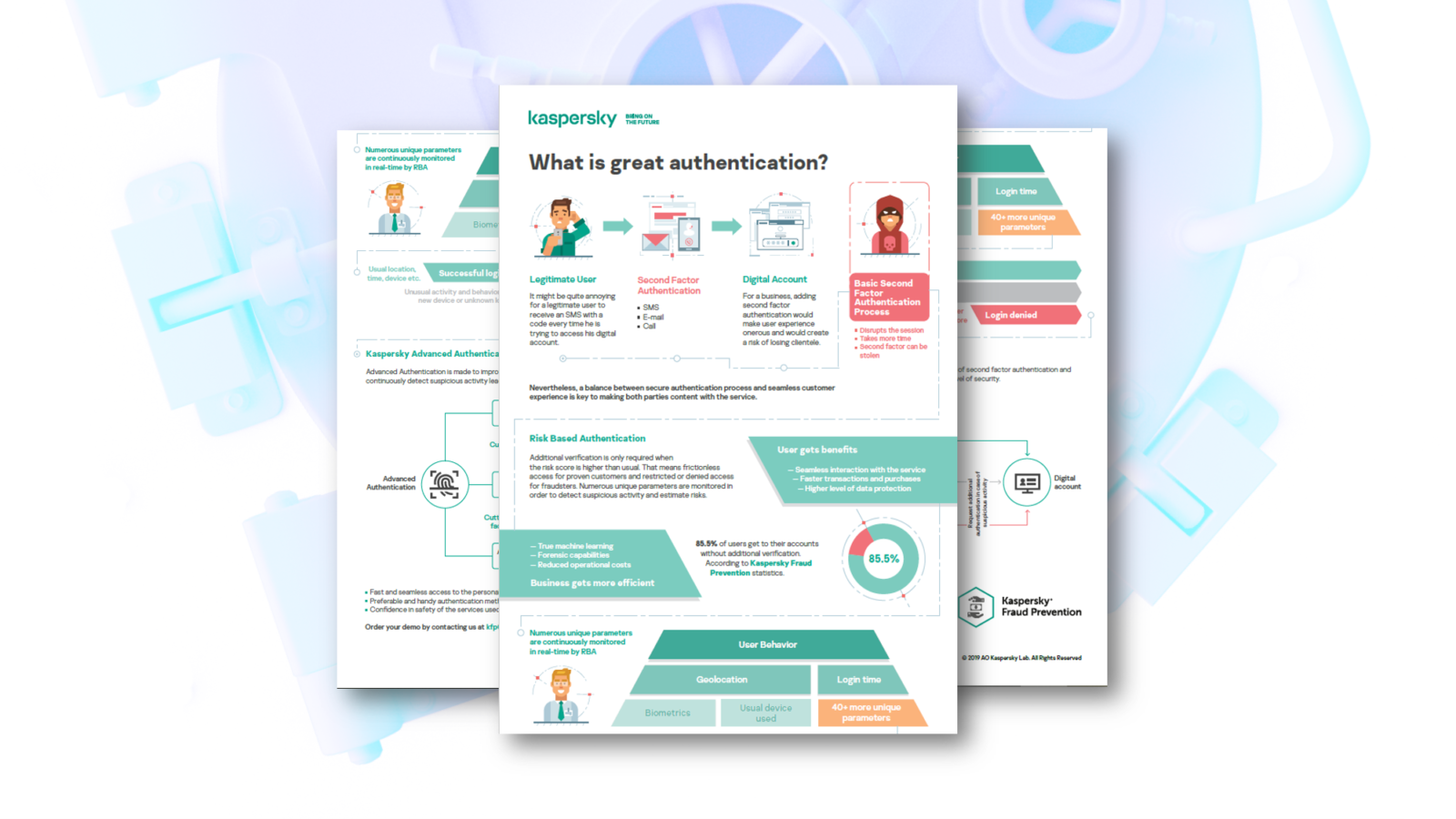

Additional levels of security, however, may harm the user experience. More authentication steps alienate digital experience for the clients, lowering the level of satisfaction and making them think of some competitive solutions.

Kaspersky Fraud Prevention uses a complex range of advanced technologies with machine learning applied for proactive detection of sophisticated fraud schemes across web and mobile channels, in real-time, before the transaction occurs.

The platform analyzes not only the login moment, but also the whole session and makes decisions based on the overall reputation of devices and accounts over time allowing for the efficient detection of complex fraud attacks. Context authentication used for risk assessment detects legitimate users with high level of accuracy, letting them into their digital accounts without additional unnecessary friction.